Understanding the Difference Between an EIN and a TIN

Do you know the difference between an EIN and a TIN? Not entirely sure how these tax identification numbers differ?

Key Takeaways You Will Get From This Article

1. A TIN is one that is issued by the Social Security Administration or the IRS and should be used for tax returns and other tax related documents.

2. An Employer Identification Number (EIN) is a tax ID for business entities such as LLCs and corporations.

3. The similarity between these two numbers is that they are both used to identify individuals for tax recording reasons.

4. The primary difference between the tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies.

Electronic Merchant Systems offers payment method solutions, creating a simple and seamless payment experience for your valued customers. We empower companies with mobile processing, web commerce, and POS Solutions. We understand the importance of digital and e-commerce literacy - especially when it comes to EINs and TINs.

If you are living in the United States, it goes without saying that you will need to pay your taxes.

There are two main types of identification when it comes to taxes - the Taxpayer Identification Number (TIN) and the Employer Identification Number (EIN).

While these terms may not be new to you, you may not know how to distinguish between the two as they are often used interchangeably. Luckily, we are here to help.

Below, we explain the similarities and differences between these two numbers and explain how they are used in the context of taxes.

What is a TIN?

A TIN is one that is issued by the Social Security Administration or the IRS. More specifically, the Social Security Administration issues American citizens with a social security number (SSN), and the IRA issues Individual Taxpayer Identification Numbers.

The word TIN is an umbrella term that covers the entire range of tax identification numbers. This number should be used for tax returns and other tax-related documents.

The numbers are relevant as they assist in governing and administering the tax laws of the land, among other functions.

Whether you are paying independent Contractor Fees, L1 Visa, OPT Visa, E2 Visa, or TN Visa fees, you need a TIN.

Some of the numbers used when reporting taxes on a tax form include:

- Employer Identification Number

- Individual Taxpayer Identification Number

- Social Security Number

- Preparer Taxpayer Identification Number

- Adoption Taxpayer Identification Number

Who Needs a TIN?

A TIN is used to identify those who cannot obtain the social security number but do business or other types of income-earning work within the United States.

You will need a TIN if you fall in any of these categories:

- Non-resident alien who should pay taxes

- Resident alien who should pay taxes

- Non-resident who is claiming tax treat benefits

- Dependent or spouse of a non-resident visa holder

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a tax ID for business entities such as LLCs and corporations.

It is also known as the Federal Tax Identification number or federal employer identification number and is a nine-digit number that comes in an xx-xxxxxxx format and text that denotes the type of business running.

You will need this number to open a business bank account.

Usually, the business could be a non-profit, estate of decedent, employer, corporations, partnerships, governmental agencies, trusts, or any other type of business entity.

Do All Businesses Need an EIN?

Not all businesses in the US will need an EIN to file taxes.

For instance, an LLC or sole proprietorship that does not have employees will not need an EIN and can simply use the personal SSN of the owner when filing taxes.

This makes sense as a sole proprietorship is already a legal entity that can be identified through its owner and doesn't exist separately. The same case applies to an LLC that acts as a separate legal entity but not a separate tax entity.

The income earned in an LLC is reported by its owner on their personal tax returns or income. Therefore, if the LLC does not employ workers, the owner is a sole proprietor.

Comparison Between EIN and TIN

If you're a business owner, you may be curious about the two of these numbers. In as much as these two numbers, they share some similarities, as we outline below:

Similarities

The similarity between these two numbers is that they are both used to identify individuals for tax recording reasons.

Differences

The primary difference between these tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies.

Therefore, the difference is in the way the EIN and tax ID numbers can be used. Furthermore, an EIN is a type of TIN. Therefore, you can use a TIN in place of an EIN. However, you cannot use an EIN in place of a TIN.

Another difference between these two numbers is that the TIN can be received immediately after verification is complete at no cost, while an EIN needs time as state guidelines have to be checked before it is issued.

How to Get a TIN or an EIN

Getting a TIN and EIN is different. Below, we explain everything you need to know about getting these numbers:

Getting a TIN

Since there are different types of TIN, you need to be specific on the type you need. The Social Security Administration issues social security numbers. Other types of TIN are issued by the Internal Revenue Service.

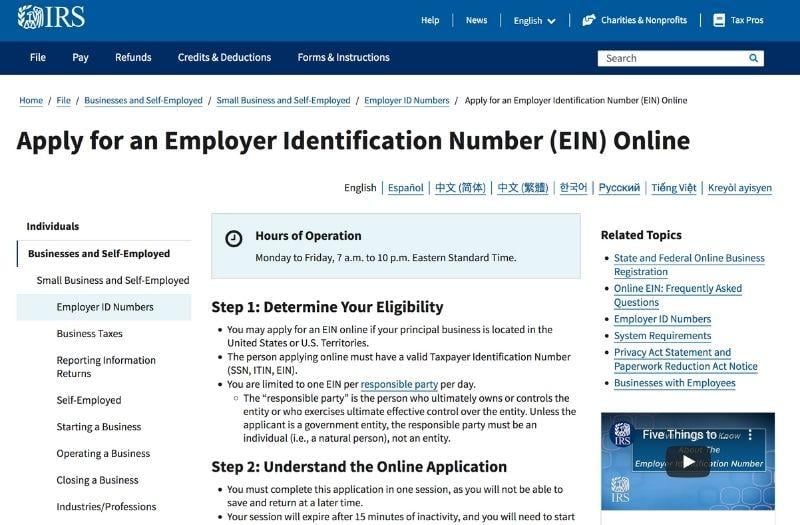

Getting an EIN

EINs are issued by the IRS to businesses. You can receive an EIN by applying in several different ways, including:

Fax Application

To apply for the EIN by fax, you must fill out form ss-4 and fax it to your state's fax number. It is easy to find the correct state fax number online.

Before you send your fax, it is crucial that you ensure that the information on the form is correct and up-to-date. Additionally, you should include a fax number in the application to allow IRS to send you the EIN in four to five working days after processing your request.

Online Application

Apart from applying by fax, you can apply for an EIN online. Online applications are fast and seamless, which means the process should be complete in a day or two.

Once you finish filling in the SS-4, the information will be validated, and then you will receive the EIN.

Telephone Application

You can apply for an EIN number by calling (267) 941-1099. The Third Party Designee on the ss-4 must be completed, giving the person named the authority to receive an EIN for the business.

This authority is terminated once, and the designee assigns and receives the EIN for the number.

Mail Applications

Applying for an EIN by mail can be a long and tedious process that can take up to 4 weeks.

You will need to complete and file the form SS-4 at the IRS office in your state. You can find the right office address online.

The EIN will be mailed to your physical location as you entered in the form once verification is complete.

Get Started with Electronic Merchant Systems

Now you have the understanding of EIN vs. TIN under your belt. That is one thing crossed off your to-do list as a business owner and many more to go.

If you're in the market for the very best merchant services and payment processing, look no further than Electronic Merchant Systems.

With over 30 years of experience and a 4.7/5 stars Google Review rating from over 1,000 actual customers, there’s a reason why merchants all over the country choose EMS as their merchant services provider.

Related EMS Blog Articles -

Click below to schedule a Free Consultation with our payment processing team to put your business in the best position to succeed.