Innovative, cost-effective payment processing

We are a leading payment processing company with more than 30 years of experience assisting businesses like yours.

Customer FeedbackBased on 1,000+ Google Reviews

“EMS has been a pleasure to work with. Always providing great customer service. Our representative is always available to assist and as a small business we appreciate that.”

Expert Guidance

We currently serve tens of thousands of business owners across the United States, each with a tailored payment solution that suits their unique needs.

Lower Rates and Fees

We offer the lowest rates possible to help you increase profitability. In fact, 95% of business owners who receive our free rate review end up saving money.

24/7/365 Customer Support

Yes, you read that right! Whether you have a question at 3PM or 3AM, our U.S.-based support team is standing by to assist you.

Payment Solutions

Accept Payments Online,

In-Person, or On the Go

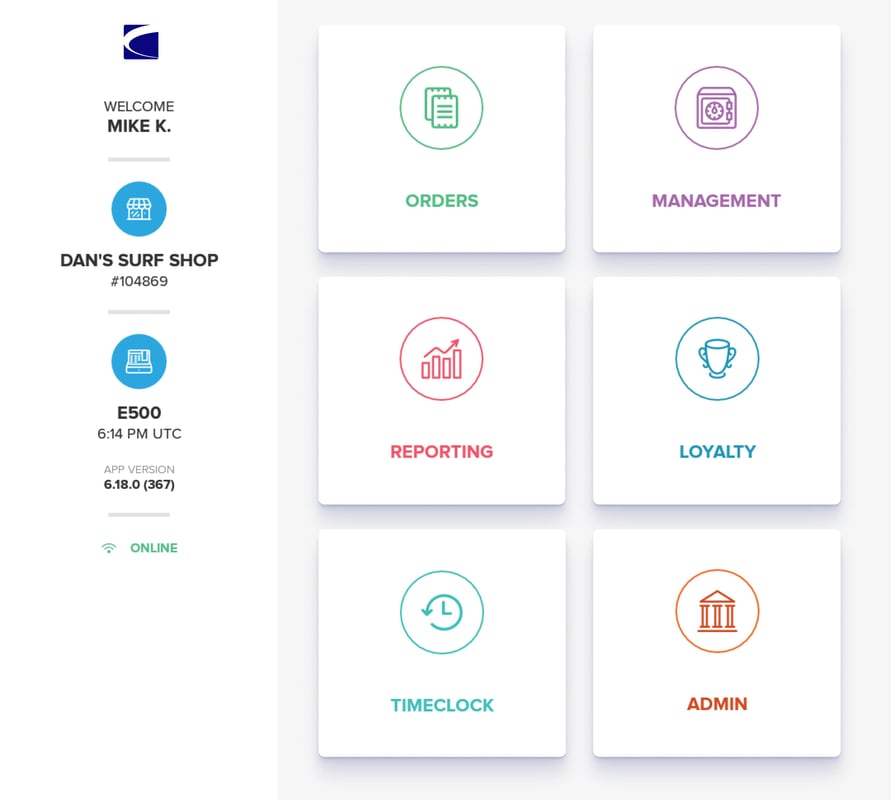

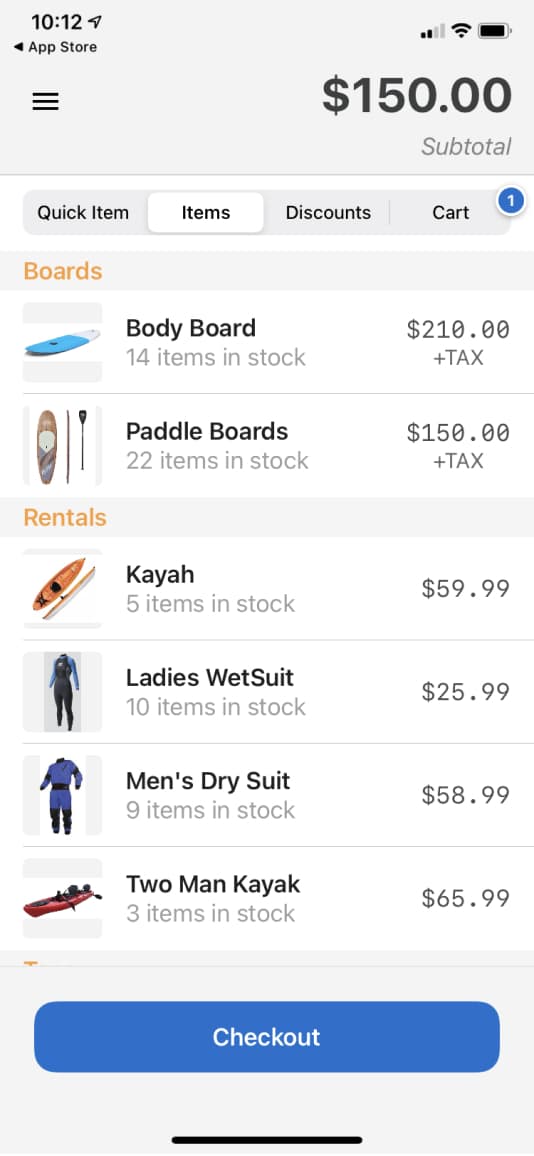

Point of Sale Solutions

Do you need a tailored payment solution for your restaurant or retail business? We offer multiple point of sale options to help you streamline operations, increase efficiency, and improve the customer experience.

Learn More

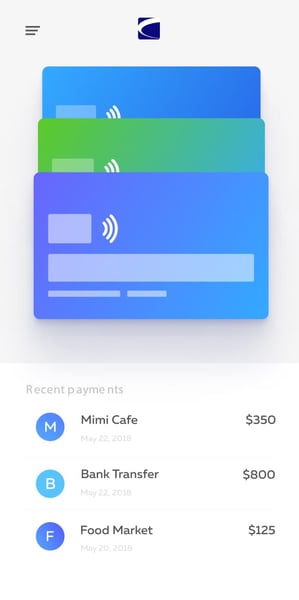

Online Payments

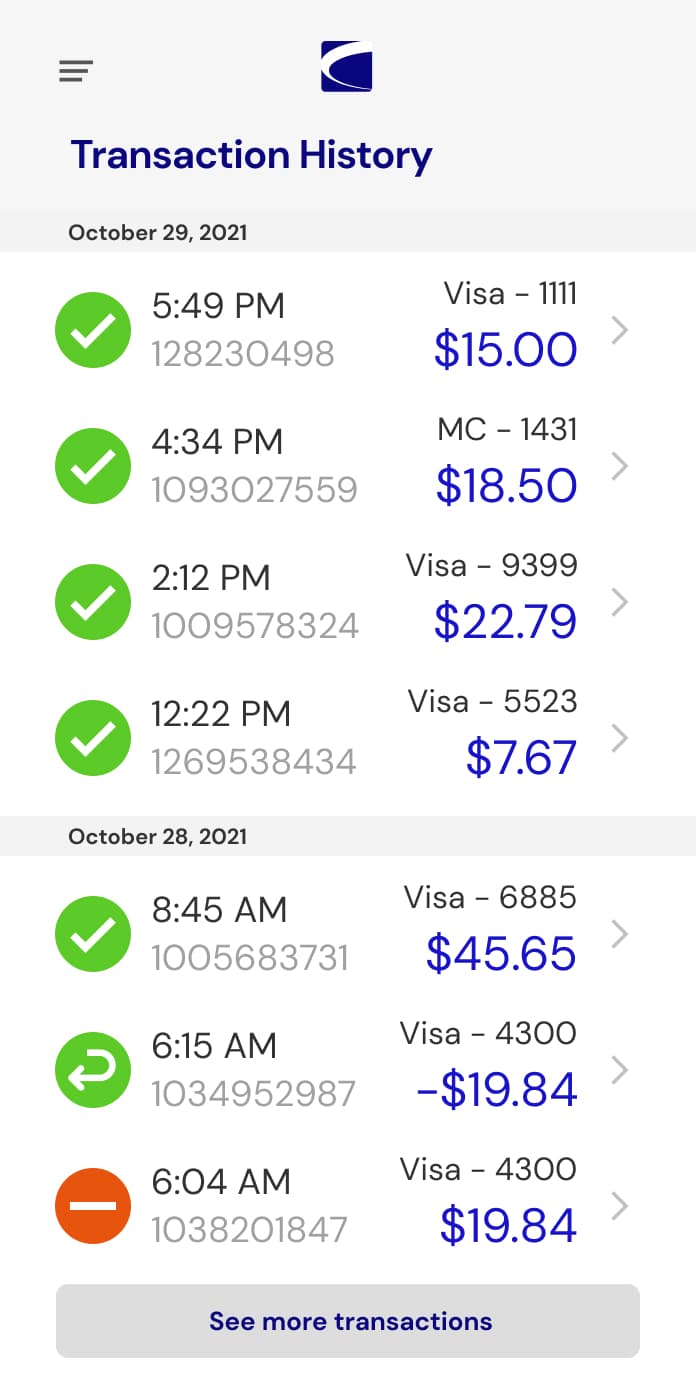

Take advantage of the flexibility to accept payments online! Our payment gateway solutions offer a powerful, secure virtual terminal along with seamless integration to online stores. Plus, advanced features are available to help you manage your business.

Learn moreMobile Processing

If you’re conducting business on the go, don’t have a typical storefront, or lack the space for a credit card machine, a mobile processing solution could be the answer!

Learn More

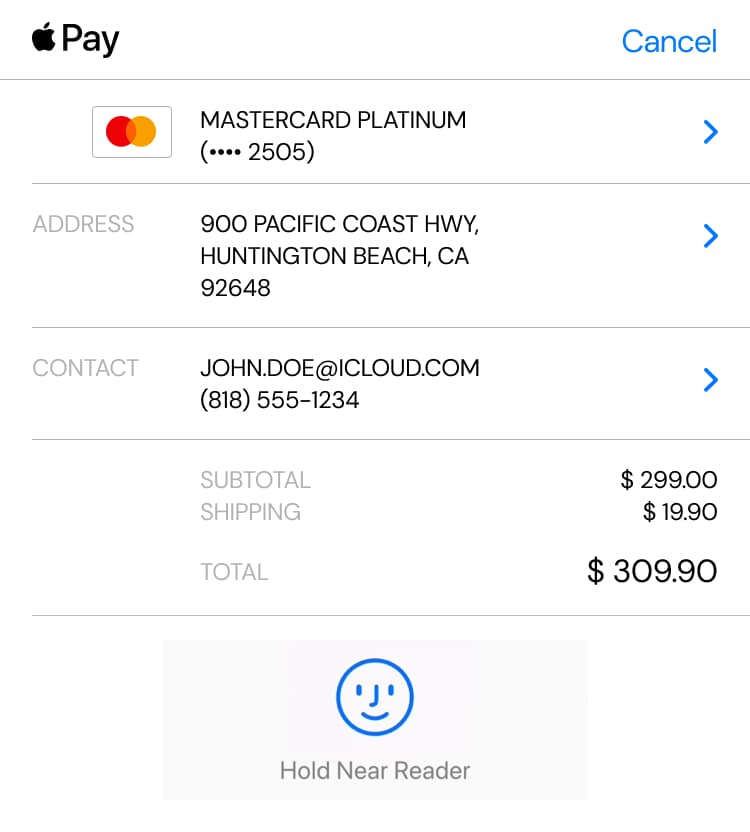

Access 0% Processing Rates

Eliminate credit card processing costs with our Surcharge or Dual Pricing Program. These programs can put hundreds of dollars back in your pocket every month and greatly improve your bottom line.

Surcharge Program

Offset the cost of accepting credit cards by applying a service fee to all credit card sales.

Dual Pricing Program

Save money on fees by offering a discounted cash price on all sales.

Payment Processing for All Business Types

Integrations Developed with You in Mind

We partner with reputable companies to bring you the best solution possible. Whether you need a website, online shopping cart, payment gateway, or other custom application, you can trust that EMS has the resources to build a tailored solution that lasts.

One Team, One Vision

Get to Know the EMS Team

The EMS team is the driving force behind the success of our mission. Together, we serve our customers and company with integrity, kindness, and determination. The diverse aptitudes and perspectives each team member brings to their work is a huge part of what drives us to successfully empower the business owners we serve.

Let’s find the right solution for your business.

-

Build a Plan

-

Implement & Save

-

Receive Ongoing Support